Australia is still a popular place for international and domestic investment in the property sector. Australian property is expected to remain strong in 2023 with the industrial and residential sectors leading the tenant demand. Increased interest rates are being felt on a global basis and investors are looking for stable environments to invest in, which makes Australia a popular destination due to transparent government policies, population growth, infrastructure development, and demand for quality space.

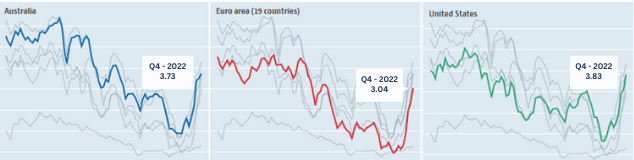

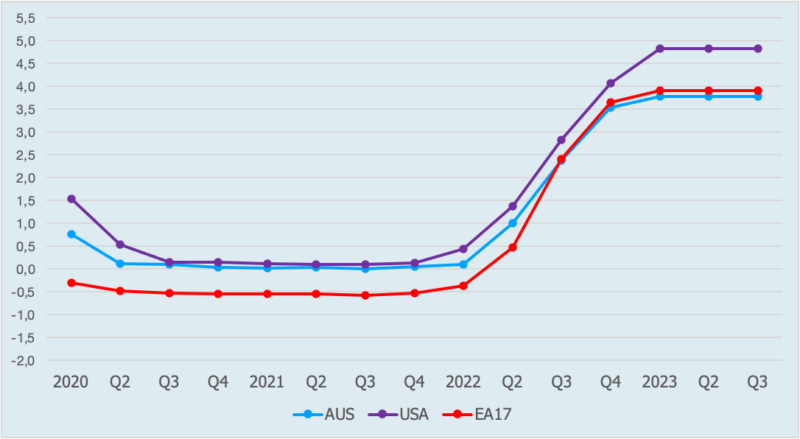

Australia has seen a record 10 rate rises in a row with a further 2 to 3 rises predicted in the next quarter. This is in line with global markets. The cash rate has gone to a level of 3.60% in the last 12 months and is expected to rise to over 4% by the end of 2023. Short-term Interest Rates will match this (+2%) and expect to level off around 6 to 6.5% by the end of 2023 (RBA March 2023). A rate decrease will be unlikely in 2023 but may happen in 2024.

While rates are putting pressure on investment assets, the lack of supply, low vacancy rates, and increased rent have generally helped assets retain their value. Industrial and box retail are asset classes TPA believes will maintain longevity for property investors.

In the last 6 months, TPA has seen a slowdown of good value investment properties coming to market due to vendors’ expectations remaining high and not reflecting the change in market conditions. This vendor stance is slowly changing, and we expect to see more investment activity over the next 6 to 9 months however we don’t expect a big change in pricing. There are pockets of locations and asset types that present good opportunities in the current market. Southeast Queensland (SEQ) should be a good example of this in 2023-2024. Melbourne and Sydney areas seem to be holding their price; however, we would expect a relaxation to these areas later in the year.

“It is expected Brisbane rents to continue to grow at above historic rates over 2023-26 due to solid population growth, relatively cheaper rents (compared to other major cities in Australia), as well as continued demand for space by large occupiers that already have a presence in Sydney and Melbourne.” (CBRE 2023)

TPA will also be looking for a cash investment for properties through 2023 with the intent to finance when rates stabilize. Construction price looks to be stabilizing and may even come down over the next 6 months due to less activity in the building industry due to higher inflation and interest rates. TPA also likes the childcare and retirement living sectors which have a lack of supply and have strong government support for funding and development. The financial markets have had a seismic shift over the last 12 months; however, this is more a market normalization or market correction from historic low-interest rates, rather than a collapse of any sort. The real estate market still presents strong fundamentals with good yields and capital growth and TPA is currently exploring several opportunities we hope to bring to our investor base in the coming months.